ESG at KGI Financial

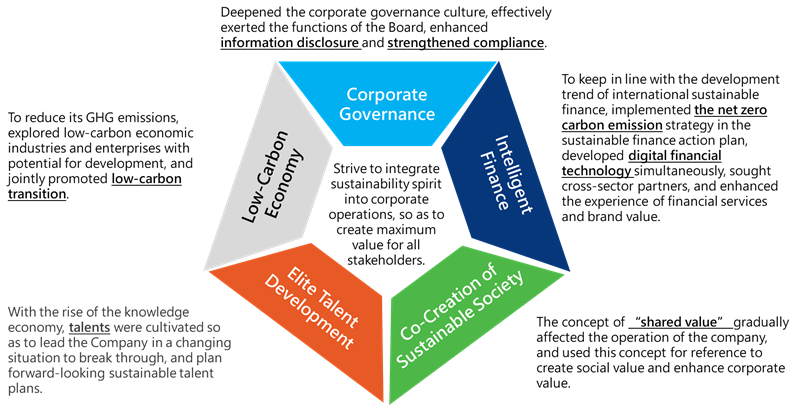

The global environmental crisis is a challenge we are duty-bound to address. Our five sustainable management strategies represent not just a pledge but also essential goals we are committed to achieving.

Materiality

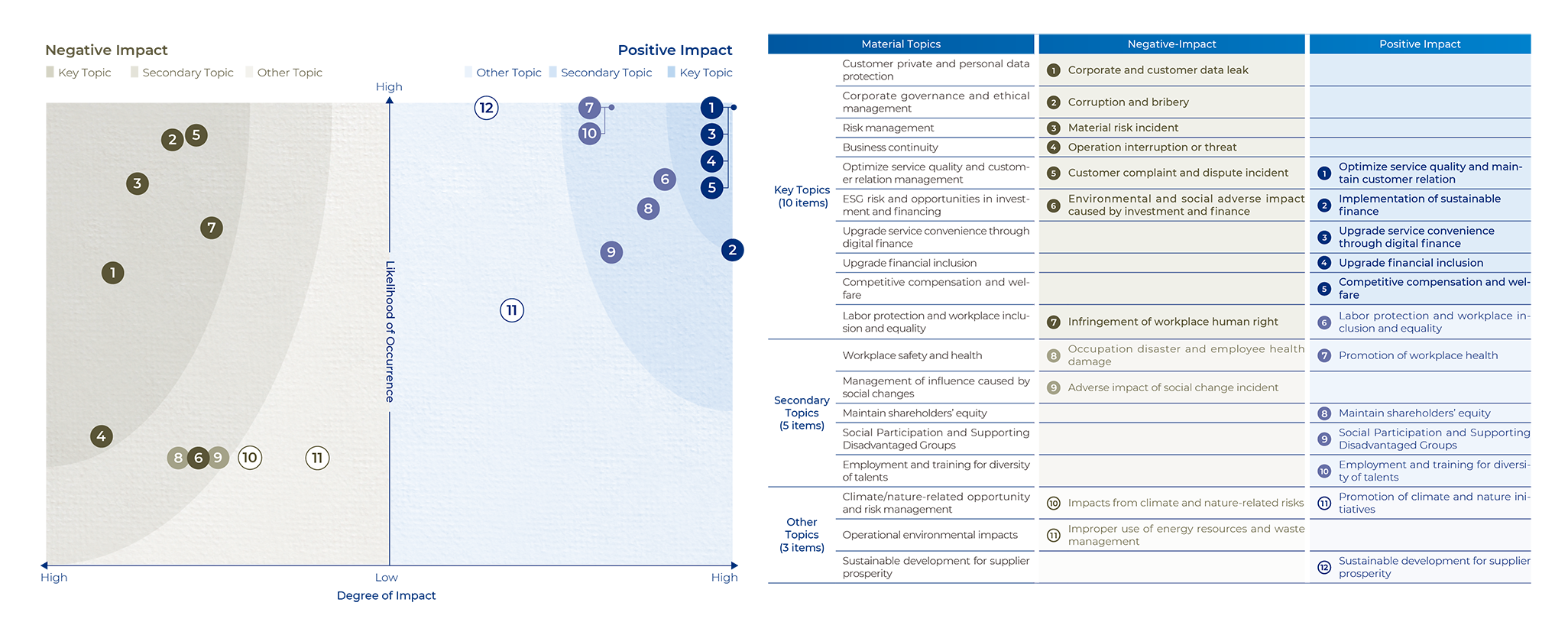

KGI Financial refers to international ESG trends, benchmark enterprises domestically and abroad, as well as domestic and international evaluation indicators to conduct annual materiality assessment and identification of sustainability issues. Following GRI standards, it performs a comprehensive evaluation of the "impact magnitude" and "likelihood of occurrence" for both positive and negative impacts of sustainability issues, resulting in the materiality ranking outcomes and integrated matrix of positive and negative impacts for the year. In 2024, KGI Financial utilizes due diligence and public opinion analysis to understand stakeholder perspectives, subsequently adjusting the positive and negative impacts of sustainability issues. Ultimately, it produces the 2024 materialities impact matrix and ranking outcomes, which are submitted to the Sustainability Committee at the board level for resolution.

Stakeholder Identification

KGI Financial conducts an annual review of stakeholders' key concerns. In 2024, following the AA1000 Stakeholder Engagement Standard (AA1000SES), it will analyze international sustainable development regulations and trends based on five principles: accountability, influence, tension, diverse perspectives, and dependency. Referring to domestic and international peers, KGI Financial will examine and establish its eight key stakeholders (shareholders and investors, employees, customers, communities, investees, suppliers, government and regulatory authorities, and media). Through due diligence channels, it will identify issues of concern to stakeholders in daily operations and incorporate them into its considerations.

Material Issues Identification

Step 1

View sustainability issues and impacts

Material Topics

18

Material Topics

Based on the 19 major themes of 2023, the 2024 adjustments reference international sustainability development trends and domestic and international leading peers, reducing the major themes to 18. "Climate Opportunity and Risk Management" is adjusted to "Climate/Natural Opportunity and Risk Management," while "Energy Resource Consumption" and "Waste Management" are consolidated into one theme, "Operational Environmental Impact." Due diligence and public opinion survey statistical analysis are incorporated to comprehensively evaluate the impact level and likelihood of occurrence for each major theme, adjusting the ranking of major themes accordingly. "Labor Protection and Workplace Inclusion and Equality" is upgraded from a secondary theme to a key theme.

Step 2

Stakeholder survey

WORKING GROUPS (WGS) OFSUSTAINABILITY

6

WORKING GROUPS (WGS) OFSUSTAINABILITY

Through the KGI's due diligence channels and public opinion analysis, understand the opinions of stakeholders and incorporate them as a basis for adjusting the positive and negative impacts of significant topics.

Stakeholders Groups

8

Stakeholders Groups

Through the KGI's due diligence channels and public opinion analysis, understand the opinions of stakeholders and incorporate them as a basis for adjusting the positive and negative impacts of significant topics.

Step 3

Assessing impact and prioritizing materiality

Impact

23

Impact

Reference the 2024 KGI Financial due diligence channels, public opinion survey statistical analysis results, and base the evaluation on the 2023 sustainability issue materiality ranking to assess the likelihood and impact level of positive and negative impacts for each issue. Prioritize negative impacts, compile the ranking results of positive impacts, and finally comprehensively adjust the materiality levels of sustainability topics. Divide the 18 major issues into three levels: critical, secondary, and other topics, and update the 2024 materiality matrix and major topic rankings.

Step 4

Prioritizing and adjustment assessment results

key topics

10

key topics

After assessing the positive and negative impacts comprehensively, the results of converging on major topics analysis revealed a total of 10 key topics, 5 secondary topics, and 3 other topics. During the analysis process of major topics, KGI Financial referred to the suggestions of stakeholders and external experts and decided to recognize the sustainability issues of key topics as the subjects to be disclosed in this year's report.

Step 5

Reporting and disclosing content

ESG Report

1

ESG Report

The material topics result was submitted to the Sustainability Committee for review and approval in March 2025. The ESG Report is compiled based on these material topics and discloses the strategies, targets, and implementation status of the sustainable development plan, which is regularly reported to the Sustainability Committee and the Board of Directors for performance monitoring.

Material Issues Matrix

Next

Environmental

We have made environmental protection and sustainable development our major mission and consistently uphold our responsibility to address these issues.