KGI Financial aligns with the UN Principals for Responsible Investment (UN PRI). Our major subsidiaries, including KGI Life, KGI Bank, KGI Securities, KGI SITE, and CDIB Capital are all signatories to the “Stewardship Principles” of the Taiwan Stock Exchange Corporation and comply with its six main principles. We implement 'stewardship' by incorporating ESG management procedures into investment decisions, hence, we make a sustainable finance impact on enterprises to assist companies in paying attention to ESG related issues. An investment portfolio built on the ESG is not only potentially beneficial, but also offers a triple-win opportunity for the good of the environment, society, and corporate governance. In the meantime, to deepen the internal ESG core values, the “Responsible Finance” working group is established responsible for planning KGI Financial's sustainable financial blueprint. Based on needs, it will convene at least three times a year to discuss and develop sustainable development plans and oversee the implementation of responsible investment strategies and policy directions.

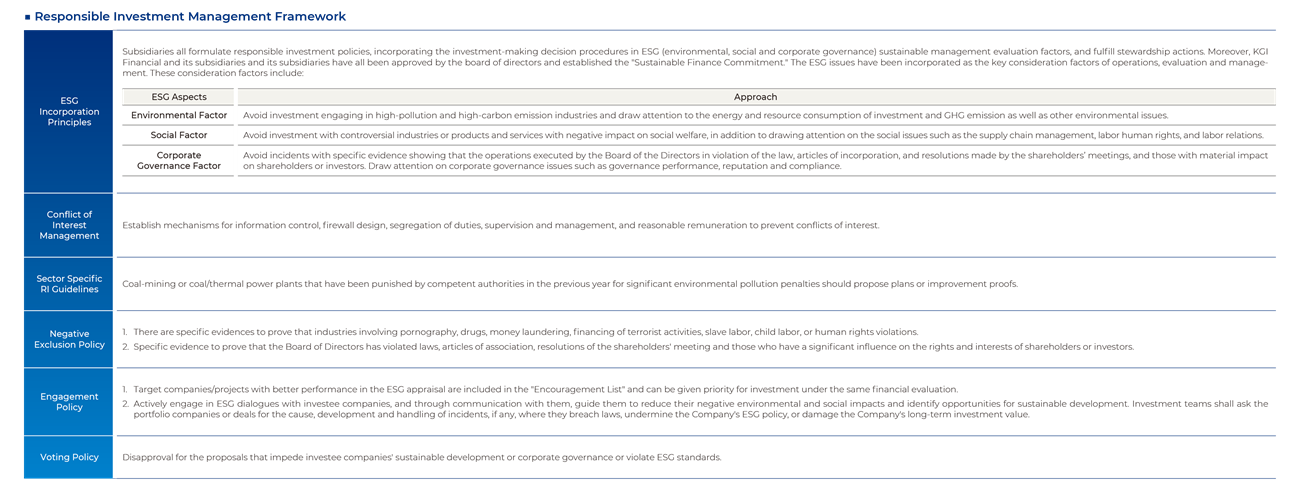

In order to implement the “Sustainable Development Goals” (SDGs) of the United Nations, KGI Financial and its subsidiaries have been approved by the board of directors and established a "Sustainable Finance Commitment." The Sustainable Finance Commitment applies to the Company and its major subsidiaries, including KGI Life, KGI Bank, KGI Securities, KGI SITE, and CDIB Capital. This commitment covers all domestic and international business operations and investment activities. Investment and financing activities encompass active investments, passive investments, and outsourced investments in proprietary positions, as well as credit business; whereas asset types include listed equity, fixed-income securities, private equity, real estate investments, and financing.

| UN PRI | KGIF's Implementation |

|---|---|

|

Incorporate ESG issues into investment analysis and decision-making processes |

All major subsidiaries of KGI Financial have established responsible investment policies, and ESG review conditions and standards (including Exclusion and Sector-Specific Standards), and ESG issues are taken into consideration in investment decisions.

|

|

Be active owners and incorporate ESG issues into our ownership policies and practices |

All the major subsidiaries of KGI Financial have signed the “Stewardship Principles” issued by the Taiwan Stock Exchange Corporation, and have formulated relevant protocols and voting policies to actively engage in ESG-themed conversations with investee companies, guiding them to reduce negative environmental and social impacts and explore opportunities for sustainable development.

|

|

Seek appropriate disclosure on ESG issues by the entities in which we invest |

We review and pay attention to the material ESG issues of investee companies in accordance with local authorities' requirements for the disclosure on ESG issues, including but not limited to ESG reports and ethical corporate management best practice principles. |

|

Promote acceptance and implementation of the PRI within the investment industry |

KGI Financial and its subsidiaries actively participate in sustainability forums and exhibitions. In 2024, we joined the Net Zero Cities Exhibition to engage investors in interactive net-zero experiences, promoting key green finance initiatives: "Sustainable Investment, Driving Net Zero Transformation," "Green Finance, Accelerating Industry Sustainability," "Innovative Finance, Advancing Sustainable Co-Prosperity," and "Digital Innovation, Achieving Sustainable Insurance." These efforts demonstrate the Company's commitment to sustainable finance and its broader impact. |

|

Work together to enhance our effectiveness in implementing the PRI |

In order to assist the financial industry to strengthen the risks brought about by climate change, KGI Financial joined the Partnership for Carbon Accounting Financials (PCAF) in June 2023 to apply its financial asset carbon emission calculation methodology and database and assist corporate clients to promote low carbon transformation, in line with the “Green Finance and Transition Finance Action Plan” proposed by the FSC and is committed to exerting financial influence. |

|

Each report on our activities and progress towards implementing the PRI |

In addition to regular disclosures on compliance with stewardship in accordance with “Stewardship Principles“, KGI Financial, KGI Life, and KGI Securities have publicly disclosed the implementation of responsible investment in the respective ESG reports.

|

While investing, the Group takes into account ESG factors in target selection for management to make decisions and takes over stewardship to improve investment value and for sound development of both the Group and investee companies.

• Create an exclusion list

• Review and assess sector-specific requirements

• Conduct ESG due diligence on investment targets in dispute

• Hold investment review meetings

• Decide on the investment amount

• Keep track of proposals that could adversely affect the sustainable development of investment targets or ESG principles

• Exercise the right to vote and disclose the votes at a shareholders' meeting

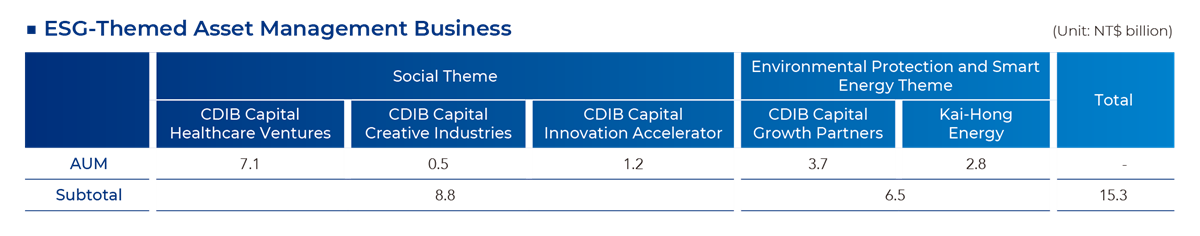

Note: CDIB launched the CDIB CME Fund to support the cultural & creative industry in Taiwan. Among this fund, a total of NT$101 million was invested in the film and television industry in 2024.

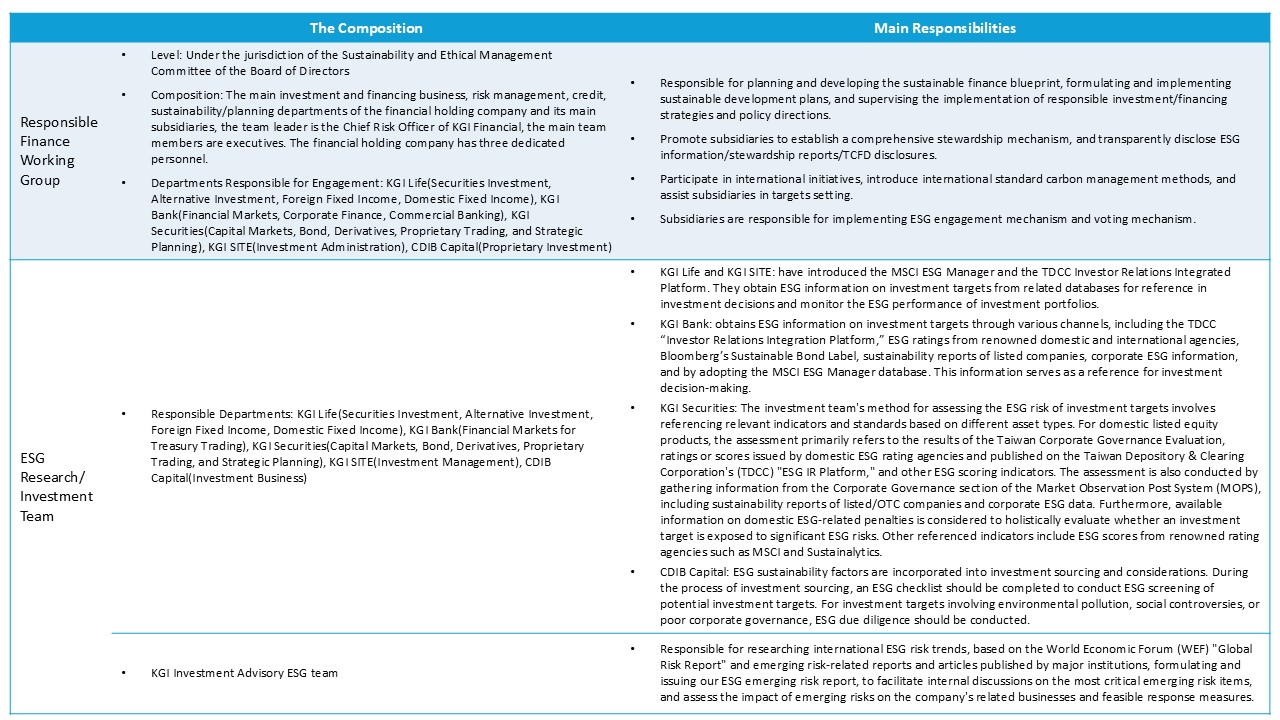

KGI Financial values sustainable governance and practices corporate social responsibility. KGI Financial and its main subsidiaries have all established Sustainability and Ethical Management Committees under the board of directors, and each of them has established a Responsible Finance working group. We are committed to following the United Nations Principles for Responsible Investment (PRI), Principles for Responsible Banking (PRB), and Principles for Sustainable Insurance (PSI), and support sustainable economic activities. The composition and main responsibilities of the responsible finance working group are as follows: