Social

We take a long-term perspective in empowering students from disadvantaged backgrounds, committed to industry-academia collaboration and talent cultivation, with the hope of injecting new vitality into Taiwan’s societal resources.

Social Investment

In 2024, KGI Financial launched a new volunteer project titled "Regional Revitalization Changemakers" in collaboration with 17 high-quality local revitalization organizations across Taiwan, aiming to identify the challenges faced by these groups. Employees with relevant expertise are invited to join and form volunteer teams, engaging directly with local communities to understand their needs and co-creating solutions alongside the revitalization organizations. KGI Financial has also established a cross-group "Regional Revitalization Resource Matching Committee" as an integrated platform to respond to the needs of the revitalization organizations. The volunteers, demonstrating empathy and professionalism, assisted the revitalization groups in organizing finances, optimizing the business model for corporate collaboration, and connecting over 80 internal and external resources. By the end of 2024, the Group had contributed over 7,500 service hours and generated more than NT$2.4 million in revenue for the revitalization organizations.

List of Performance and Target

ITEM

PERFORMANCE

TARGET FOR NEXT YEAR

PROMOTE INTERGENERATIONAL COLLABORATION

PROMOTE INTERGENERATIONAL COLLABORATION

ITEM

Develop Healthy Farmland

PERFORMANCE

- Strengthen the corporate image of KGI Financial in supporting intergenerational collaboration

- Through the collaboration with Food Healthy Limited Company to call on local young farmers to participate in financial consultation seminars and to assist local young farmers in developing financial management and financing capabilities

TARGET FOR NEXT YEAR

- Establish a model for the cooperation between enterprises and young farmers, and assist more young farmers who return to their hometowns in utilizing environmentally friendly agriculture to grow crops and work sustainably

TAKE CARE OF THE ELDERLY

TAKE CARE OF THE ELDERLY

ITEM

Promotion of self-supporting community for the elderly by KGI Financial and Plahan

PERFORMANCE

- Assist disadvantaged elderly and persons with disability in tribes of Heping District, Taichung City to repair the chicken coops, compost facilities, and create monthly productivity of 3,000 eggs per month

- Support Plahan Symbiotic Community Hub to train local caregivers, expanding the All-in-One elderly care model to extremely rural areas such as Lishan Tribe, helping the local elderly to receive care and age in place

TARGET FOR NEXT YEAR

- Support the “All in One” model to be promoted in other counties and cities

SEEK COMMON GOOD WITH THE DISADVANTAGED

SEEK COMMON GOOD WITH THE DISADVANTAGED

ITEM

Volunteer service project

PERFORMANCE

- In 2022, the total number of volunteer service hours reached 77,660 hours, benefiting over 10,000 people

- Built altruistic corporate culture and enhanced brand recognition to stakeholders

TARGET FOR NEXT YEAR

- Increase volunteer service hours to an average of 6 hours per person per year

- Achieve an average of 8 volunteer service hours per person per year in long term

SEEK COMMON GOOD WITH THE DISADVANTAGED

ITEM

Scholarship for skilled vocational high school students

PERFORMANCE

- In 2022, KGI Financial Foundation invested a total of NTD 3,171,406 and benefited 118 students.

- Through the Foundation's “Visibility to People” program, the benefitted students lectured in the dance, swimming and art classes held for employees. 363 people benefited.

TARGET FOR NEXT YEAR

- Continue putting in resources to develop more talents in different areas

SEEK COMMON GOOD WITH THE DISADVANTAGED

ITEM

KL Financing Classes for the Elderly

PERFORMANCE

- In 2022, 10 physical activities were held, with 340 people attending

- Utilized insurance expertise to implement inclusive finance, instilled a culture of fair customer treatment internally, and demonstrated KGI Life’s care for the disadvantage externally to promote the image of sustainable finance

TARGET FOR NEXT YEAR

- Continue to promote equality in financial literacy for rural/disadvantaged groups

COEXIST WITH THE ENVIRONMENT

COEXIST WITH THE ENVIRONMENT

ITEM

Water Refill Campaign

PERFORMANCE

- In 2022, KGI Life has helped reduce a total of 16,225 plastic bottles and a total carbon reduction of 1,508.96 kg

- Supported Circular Economy & Carbon Reduction 100+ initiative to reduce plastic waste and enhanced KGI Life’s brand recognition

TARGET FOR NEXT YEAR

- Improve the effectiveness of the Water Refill events and promote them via public welfare or business activities

SOCIAL RETURN ON INVESTMENT (SROI)

SOCIAL RETURN ON INVESTMENT (SROI)

ITEM

Social Return on Investment (SROI)

PERFORMANCE

- Heritage 100 X Tutelage 100 achieved SROI of 4.9 in 2022

TARGET FOR NEXT YEAR

- Achieve greater social impact and create more social benefits

Financial Inclusion

We have long cared for the needs of disadvantaged groups and social enterprises. Through the core businesses of subsidiaries, we devote to provide sustainable financial assistance. In recent years, in combination with the opportunities raised from emerging risk, we have continued to develop various products and services related to social welfare in order to create maximum social benefits and give back to society.

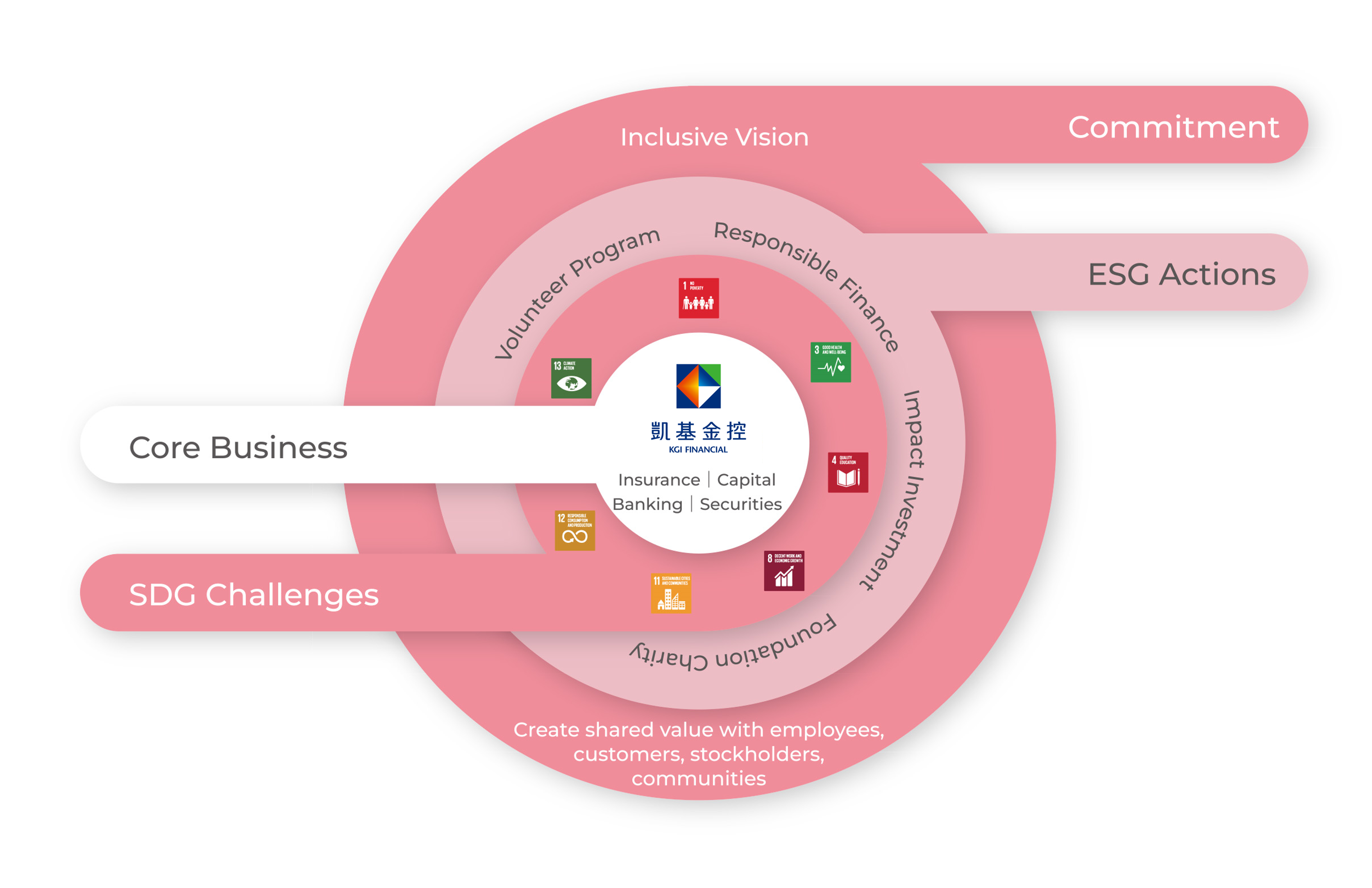

Inclusive Vision

The KGI Financial “Inclusive Vision” project aims to understand the needs of local communities through the work of the Group's volunteers, and by cooperating with social enterprises, assist establishing local sustainable support system, in order to promote intergenerational collaboration, take care of the elderly, seek common good with the disadvantaged, and co-exist with the environment to become the solid support for sustainable Taiwan.

Inclusive Vision

The KGI Financial “Inclusive Vision” project aims to understand the needs of local communities through the work of the Group's volunteers, and by cooperating with social enterprises, assist establishing local sustainable support system, in order to promote intergenerational collaboration, take care of the elderly, seek common good with the disadvantaged, and co-exist with the environment to become the solid support for sustainable Taiwan.

Micro-insurance

KGI Life actively responds to the government's promotion of inclusive financial policies, so that disadvantaged groups can also enjoy micro-insurance protection. In addition, KGI Life has been relaxed to "elderly or their family members who meet the provisions of the Elderly Welfare Law and receive living allowances for the middle- and low-income elderly (65 years old)." Therefore the group aforementioned can also apply for micro-injury insurance, receiving basic safety protection, to avoid sudden accidents have a serious impact on the family economy.

Moreover, KGI Life actively cooperates with banks, government agencies and non-governmental organizations to jointly promote micro-insurance services, extending insurance protection to every corner that needs care. To provide more coverage for the disadvantaged groups,KGI Life expanded the scope of protection and promoted microinsurance through insurance premium donation, accompanying and supporting the public with insurance, in order to survive through the different stages in life while the insurance can truly bring its function of stabilizing the society into full play. In 2022, KGI Life collaborated with Kaohsiung City to provide microinsurance coverage for 11,000 low-income household and persons with physical and mental disability who met the prerequisites. Moreover, KGI Life collaborated with Tainan City Government and the Tainan Private Chaoxing Social Welfare Charity Foundation to expand from "those with low to intermediate income households" to "those with minor and medium level of physical and mental disability (including)."

Since 2014, KGI Life has been promoting micro-insurance, and has been awarded for 8 consecutive years. The financial friendly acts of KGI Life are recognized by the Financial Supervisory Commission under the Executive Yuan, including the Outstanding Performance Award in the Micro-Insurance Competition, the Disability Care Award, and Aging Insurance Competition with remarkable performance. KGI Life builds a safety protection net for the economically disadvantaged, demonstrating the essence and value of life insurance. KGI Life offers micro-insurance with lower premiums, lower insured amounts, and easy terms to make basic accident insurance covering death and disability affordable for disadvantaged groups

Moreover, KGI Life actively cooperates with banks, government agencies and non-governmental organizations to jointly promote micro-insurance services, extending insurance protection to every corner that needs care. To provide more coverage for the disadvantaged groups,KGI Life expanded the scope of protection and promoted microinsurance through insurance premium donation, accompanying and supporting the public with insurance, in order to survive through the different stages in life while the insurance can truly bring its function of stabilizing the society into full play. In 2022, KGI Life collaborated with Kaohsiung City to provide microinsurance coverage for 11,000 low-income household and persons with physical and mental disability who met the prerequisites. Moreover, KGI Life collaborated with Tainan City Government and the Tainan Private Chaoxing Social Welfare Charity Foundation to expand from "those with low to intermediate income households" to "those with minor and medium level of physical and mental disability (including)."

Since 2014, KGI Life has been promoting micro-insurance, and has been awarded for 8 consecutive years. The financial friendly acts of KGI Life are recognized by the Financial Supervisory Commission under the Executive Yuan, including the Outstanding Performance Award in the Micro-Insurance Competition, the Disability Care Award, and Aging Insurance Competition with remarkable performance. KGI Life builds a safety protection net for the economically disadvantaged, demonstrating the essence and value of life insurance. KGI Life offers micro-insurance with lower premiums, lower insured amounts, and easy terms to make basic accident insurance covering death and disability affordable for disadvantaged groups

Charitable Trusts

KGI Bank actively uses professional financial tools as the support for social welfare organizations. As of 2022, KGI Bank has been entrusted to manage 7 public welfare trust funds with a total management amount of more than NT$29.39 million. We aim to help individuals or legal persons implement their social welfare goals, and assist in social welfare affairs and account management.

Financial inclusion

To support young people to start their own businesses and develop their talents, KGI Bank has launched the "Giving You A Hand" Revolving Personal Loan project since 2018, targeting those with vocational certificates, disadvantaged low-income households, or plan proponents of crowd-funding platforms, to provide loan preferential projects to assist its stable career development and solve its operational turnover problems. The "Giving You a Hand" Revolving Personal Loan Project offers lower interest rates than secured mortgages, encouraging young people and new entrepreneurs to obtain capital through legal financial channels. In 2020, we launched the COVID-19 Epidemic Prevention Discount Project to help those holding technical and vocational certificates affected by the pandemic to obtain funds through fast application processes and preferential prices. In 2022, there were 299 applicants, and among which, 164 applications were successful, representing a success rate of 55%.

Financial inclusion

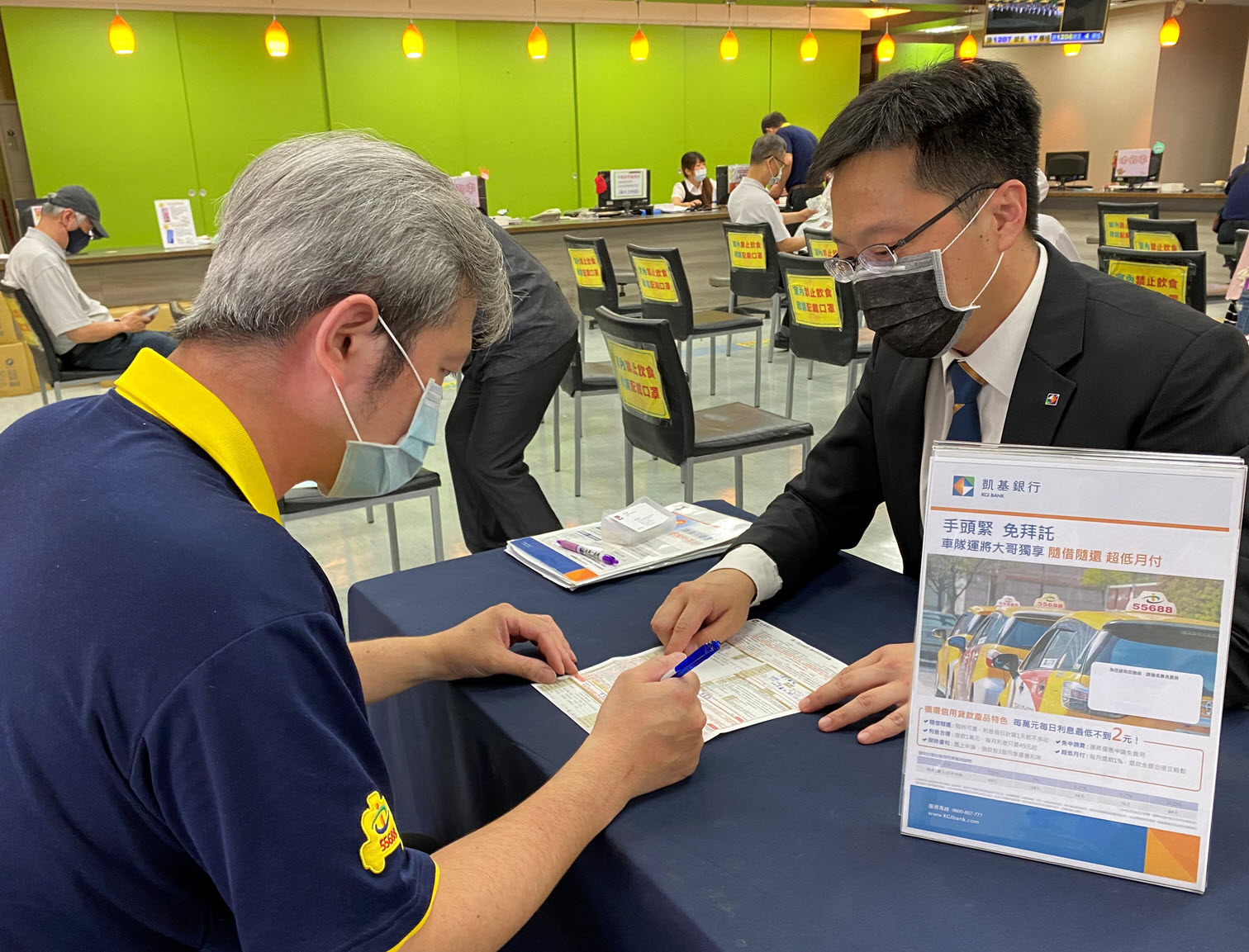

Taxi Driver Loan

Because taxi drivers cannot provide proof of fixed income, it is difficult to obtain traditional financial services. If there is a need for capital turnover, they often can only resort to underground financing channels. Based on the concept of practicing financial inclusion, KGI Bank has joined hands with the leading Taiwanese taxi fleet in the domestic transportation industry since July 2017 to proactively provide micro-credit services for taxi drivers, solving the problem of unstable income due to occupational characteristics of drivers in the past and unable to provide bank credit information or provide salary slips and other relevant financial proof, resulting in the inability to contact the bank and establish credit records and other issues. Using the big data database of the Taiwan Convoy, the "taxi driver credit scoring model" is customized, and the data such as driver service evaluation, award record, passenger load and other data are included in the credit score. Drivers can score well because of passenger service evaluation, receive credit points for high passenger numbers. In 2022, there were 267 applicants, and among which, 83 applications were successful, representing a success rate of 31%.

Because taxi drivers cannot provide proof of fixed income, it is difficult to obtain traditional financial services. If there is a need for capital turnover, they often can only resort to underground financing channels. Based on the concept of practicing financial inclusion, KGI Bank has joined hands with the leading Taiwanese taxi fleet in the domestic transportation industry since July 2017 to proactively provide micro-credit services for taxi drivers, solving the problem of unstable income due to occupational characteristics of drivers in the past and unable to provide bank credit information or provide salary slips and other relevant financial proof, resulting in the inability to contact the bank and establish credit records and other issues. Using the big data database of the Taiwan Convoy, the "taxi driver credit scoring model" is customized, and the data such as driver service evaluation, award record, passenger load and other data are included in the credit score. Drivers can score well because of passenger service evaluation, receive credit points for high passenger numbers. In 2022, there were 267 applicants, and among which, 83 applications were successful, representing a success rate of 31%.

Financial inclusion

E-Commerce Seller Loan

KGI Bank, in cooperation with Open Air Auction and PChome Pay, launched the "Big Data Loan for Open Air Auction Seller", which uses API (application programming interface) technology to simplify the application and review process of e-commerce sellers. Basic information and payment records shorten the time for sellers to fill in the application materials, and can apply online. After the application, funds can be allocated to sellers within one day, allowing sellers to immediately use funds to prepare payment for goods and expand the scale of operations, solving the problem that e-commerce sellers cannot provide traditional financial resources This project won the 2021 Digital Times "Bronze Award for Best Product Innovation" and the "Digital Inclusion Award" of the Business Times Digital Finance Awards, which is the best recognition of KGI's commitment to the practice of financial inclusion. In 2022, there were 2,295 applicants, and among which, 578 applications were successful, representing a success rate of 25%.

KGI Bank, in cooperation with Open Air Auction and PChome Pay, launched the "Big Data Loan for Open Air Auction Seller", which uses API (application programming interface) technology to simplify the application and review process of e-commerce sellers. Basic information and payment records shorten the time for sellers to fill in the application materials, and can apply online. After the application, funds can be allocated to sellers within one day, allowing sellers to immediately use funds to prepare payment for goods and expand the scale of operations, solving the problem that e-commerce sellers cannot provide traditional financial resources This project won the 2021 Digital Times "Bronze Award for Best Product Innovation" and the "Digital Inclusion Award" of the Business Times Digital Finance Awards, which is the best recognition of KGI's commitment to the practice of financial inclusion. In 2022, there were 2,295 applicants, and among which, 578 applications were successful, representing a success rate of 25%.

Financial inclusion

Delivery Person Loan

During the period of epidemic alert in 2021, the demand for delivery services has greatly increased, attracting many full-time or part-time people to enter the delivery service industry. However, when funds are often needed, it is difficult to obtain loans from banks because there is no proof of income. Therefore, KGI Bank launched the "Quick Repayment for Delivery Personnel" project, which allows screenshots of delivery remuneration to replace traditional financial documents and helps delivery partners obtain preferential loans by applying for small loans online. In 2022, there were 1,306 applicants, and among which, 549 applications were successful, representing a success rate of 42%

During the period of epidemic alert in 2021, the demand for delivery services has greatly increased, attracting many full-time or part-time people to enter the delivery service industry. However, when funds are often needed, it is difficult to obtain loans from banks because there is no proof of income. Therefore, KGI Bank launched the "Quick Repayment for Delivery Personnel" project, which allows screenshots of delivery remuneration to replace traditional financial documents and helps delivery partners obtain preferential loans by applying for small loans online. In 2022, there were 1,306 applicants, and among which, 549 applications were successful, representing a success rate of 42%

Financial inclusion

“Quick Repayment” Limited Amount Loan

In recent years, the low starting salary environment in China has made it inevitable for young people to encounter insufficient cash flow even if they are active. Therefore, the age group of customers who need micro-credit loans mainly falls between 25-39 years old. The biggest difference between KGI Bank’s “Quick Repayment” compared with other general credit services on the market is that it can be repaid at any time, and the interest is calculated on a daily basis when it is used, and there is no penalty for early repayment. You can repay at any time when you receive your salary early next month. Support young people to immediately relieve short-term capital needs, and the interest rate is relatively economical.

In recent years, the low starting salary environment in China has made it inevitable for young people to encounter insufficient cash flow even if they are active. Therefore, the age group of customers who need micro-credit loans mainly falls between 25-39 years old. The biggest difference between KGI Bank’s “Quick Repayment” compared with other general credit services on the market is that it can be repaid at any time, and the interest is calculated on a daily basis when it is used, and there is no penalty for early repayment. You can repay at any time when you receive your salary early next month. Support young people to immediately relieve short-term capital needs, and the interest rate is relatively economical.

Financial inclusion

Loans to Start-Ups in Key Industries and Micro-Business

To promote the stable development of the domestic economy, KGI Bank cooperates with government policies to provide loans for key start-up industries and loans for micro-enterprises. KGI Bank is committed to fostering the development of start-ups in key industries. In conjunction with government resources, KGI Bank has continued to target start-ups in green energy, Asia Silicon Valley, biomedicine, national defense, intelligent machinery, new agriculture, and circular economy sectors to provide a full range of financial services, and has assisted them in innovating by undergoing industrial transformation through the Small and Medium Enterprise Credit Guarantee Fund of Taiwan. For micro-businesses with smaller revenue, KGI Bank screens target customers systematically and grants micro loans quickly based on their credit ratings and standard operating procedures.

To promote the stable development of the domestic economy, KGI Bank cooperates with government policies to provide loans for key start-up industries and loans for micro-enterprises. KGI Bank is committed to fostering the development of start-ups in key industries. In conjunction with government resources, KGI Bank has continued to target start-ups in green energy, Asia Silicon Valley, biomedicine, national defense, intelligent machinery, new agriculture, and circular economy sectors to provide a full range of financial services, and has assisted them in innovating by undergoing industrial transformation through the Small and Medium Enterprise Credit Guarantee Fund of Taiwan. For micro-businesses with smaller revenue, KGI Bank screens target customers systematically and grants micro loans quickly based on their credit ratings and standard operating procedures.

Launched funds in response to social changes

Responding to aging society - CDIB Capital Healthcare Ventures

In light of the world's aging population, and prevalence of chronic diseases, there is greater pursuit for a better quality of life as income levels rise, and to capitalize on opportunities in the field, CDIB Capital Group has launched the CDIB Capital Healthcare Ventures in Taiwan. In addition, the Group has launched the RMB-denominated healthcare fund in China focused on investment in the healthcare industry in both China and Taiwan, with sub-sectors spanning biotech, precision medicine, high-end medical devices, and digital healthcare. These healthcare funds aim at assisting pharmaceutical companies, medical device manufacturing, and medical service organizations in offering quality and reasonably priced products and services. These healthcare funds' win-win proposition is to seek advanced benefits for society while creating returns. The investee company Handa Pharmaceuticals Inc. aims to develop a new orally disintegrating drugs for treatment of relapsing forms of multiple sclerosis, which can patients with difficulty in swallowing through effective improvement on medication convenience with performance update.

In light of the world's aging population, and prevalence of chronic diseases, there is greater pursuit for a better quality of life as income levels rise, and to capitalize on opportunities in the field, CDIB Capital Group has launched the CDIB Capital Healthcare Ventures in Taiwan. In addition, the Group has launched the RMB-denominated healthcare fund in China focused on investment in the healthcare industry in both China and Taiwan, with sub-sectors spanning biotech, precision medicine, high-end medical devices, and digital healthcare. These healthcare funds aim at assisting pharmaceutical companies, medical device manufacturing, and medical service organizations in offering quality and reasonably priced products and services. These healthcare funds' win-win proposition is to seek advanced benefits for society while creating returns. The investee company Handa Pharmaceuticals Inc. aims to develop a new orally disintegrating drugs for treatment of relapsing forms of multiple sclerosis, which can patients with difficulty in swallowing through effective improvement on medication convenience with performance update.

Industry-College Collaboration

To actively cultivate the next generation of financial talent, KGI Financial Group continues to invest in collaboration with universities and colleges, aiming to enhance students’ financial knowledge and help them accumulate practical experience through the following programs. In 2024, a total of 573 students participated in the industry-college collaboration initiatives.

- Summer Intern Program : offering junior undergraduate students and first-year master‘s students from local and international universities the opportunity to gain hands-on experience in the company’s operations over the summer. This program allows students to participate in important projects and explore potential career paths, helping to identify future talent for the financial industry. .

- Industry-College Collaboration Program : Collaborating with universities and colleges to establish industry-college programs, offering internship opportunities to senior undergraduate students and second-year master’s students. The initiative aims to cultivate entry-level talent for the financial sector, with outstanding interns having the opportunity to transition directly into full-time positions upon graduation.

- Corporate Mentor : Partnering with universities and colleges to serve as corporate mentors, assisting students in gaining insights into future employment trends and aligning with workplace demands. The initiative demonstrates the Group’s commitment and responsibility in nurturing talent.

- Corporate Visit : Organizing corporate visit activities to help students gain a deeper understanding of the practical operations of the financial and insurance industries while exploring potential career paths.

→More

Next

Employee Wellbeing

Employees are an important asset of the company. We provide a comprehensive system to achieve work-life balance.